Ketan Doshi

Managing Director

Tell us the key points about pay point india services that you want us to highlight in the profile.

PayPoint is a NewGen financial services firm that specializes in last mile distribution. The company's digitally connected network of about 64,000 retail stores crisscrossing the nook and cranny of India offers various banking and financial services, including Jan Dhan accounts, micro ATM services, wallets, remittances, bill payments, insurance, and more. Starting its operations in 2008, the company has come a long way to service an impressive eight million transactions per month and manages over 3.5 million bank accounts. Apart from financial services, Pay Point also offers services like travel booking mobile recharges, Amazon assisted shopping, and gift cards.

In recent times, when the pandemic has forced people to stay indoors and offices to limit their operations, digitally enabled services have become not just desirable but essential. Excellent services rendered during this phase have won the company recognition, including the 'Best Fintech and Bank Collaboration 2020' award by the Internet & Mobile Association of India (IAMAI) and as one of the 'Top 10 Cards and Payment Consultants 2021'.

Currently, PayPoint is the National Corporate Business Correspondent for State Bank of India, Bank of Baroda, ICICI Bank, NSDL Payment Bank, FINO Payment Bank and Paytm Payment Bank. It is also an authorized PPI Wallet issuer under the Payments and Settlement Act of the RBI and an authorized corporate agent under IRDA.

What are your thoughts on the current cards and payments services landscape in india? What opportunities do you foresee?

India's cards and payments business is going through a revolution, especially on the back of the government's emphasis on digitization. The recent initiatives by the RBI about ease of KYC, interoperability, allowing ATM withdrawal for wallets, and wallets companies' partici pation in the RTGS and NEFT settlement cycle have opened new doors of opportunities.

These moves have virtually put wallet companies on a par with Payment Banks. The idea is to bring even the remote locations of India on the digital banking map.

PayPoint, with the help of its wallet PayPointZ, wants to leverage this tremendous opportunity to bring cards to the masses. There is a huge demand in rural and semi urban areas where people want to join the digital bandwagon to buy goods online or avail online education. PayPointz offers cash loadable full KYC-enabled cards through its retail networks.

What Are The Differential Factors About Your Services That Make You Standout From Your Peers? Explain Your Usp?

PayPoint's strength is its deep-rooted penetration of rural and semi-urban India with a network of 64,000 retailers and a bouquet of services that help consumers meet their daily requirements without switching from one window to another.

A low-ticket size transaction needs an efficient delivery model, which our tech platform offers. Our outreach model has already touched 148 million transactions to date, and we are now servicing around 3.75 million transactions month on month. These are only financial transactions and we are not taking into account a large number of non-financial transactions, viz. balance enquiry, and more.

What is unique about the services is that it is a plug-and-play platform and has a large base of customers and retailers.

Any plans to launch products and services, especially in the area of cards and payments?

Besides offering cards for the yet untapped sections, we will provide a quasi savings account to them. PayPointz is ready with cutting edge technology for corporates where gift programs can be provided with minimal lead time. Corporates face a lot of problems in rolling out gift cards focused on incentivizing their distribution network. Our superior tech solution is designed to ease out this rollout.

How is paypoint contributing to financial inclusion and rural employment generation?

Technology and connectivity are offering that rare chance for the rural economy to bloom. At PayPoint, we have been creating a network of franchisees armed with a multi functional terminal. We provide every kind of service to consumers at the click of a mouse, be it booking a railway ticket or paying the monthly power bill. Therefore, what we essentially do at PayPoint is to play the role of the facilitator by creating a new class of entrepreneurs who, in turn, serve customers in their immediate neighborhood. This kind of financial inclusion will help them find jobs and turn job givers in their own villages and towns instead of seeking a livelihood in alien and unfriendly cities.

Financial services are not readily available at the bottom of the pyramid. We aim to ensure access to appropriate financial products and services to the last mile, especially to the low income groups.

The need for cash in rural areas is mainly met by the Business Correspondent (BC) channel. Banks are reducing the number of ATMs in rural and semi urban centers because of their extremely high operational and maintenance costs. Similarly, BC outlets associated with Pay Point India are owned and manned by local people, mostly the youth and women.

Can you tell us, with an example, how these services make an impact on society?

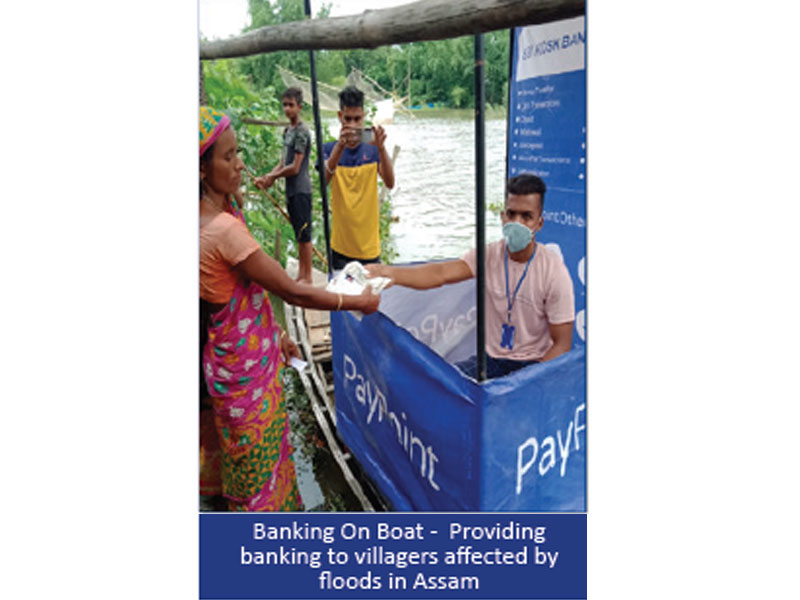

In collaboration with State Bank of India and Bank of Baroda, PayPoint has provided kiosk banking services, which include withdrawal of funds from accounts of other banks too. When Assam was reeling under devastating floods during the lockdown, one of our 'Bank Mitras' used to travel on a boat, equipped with a laptop, printer, biometric device, dongle, etc. Every morning, he would sail for over six kilometers across the furious Brahmaputra to cater to the banking needs of the poor people trapped in inundated villages. This helped them with much needed cash to meet their basic needs during the calamity. Over 2,200 residents benefited from this yeoman service. The Assam government and the Centre applauded the efforts.

It is an ongoing process, and we make sure that we reach out to the under banked areas to make financial services accessible to the rural masses. For example, in a place like Dhule in Maharashtra, we have opened the highest number of beneficiary accounts for women, and our efforts have been recognized by the SBI.

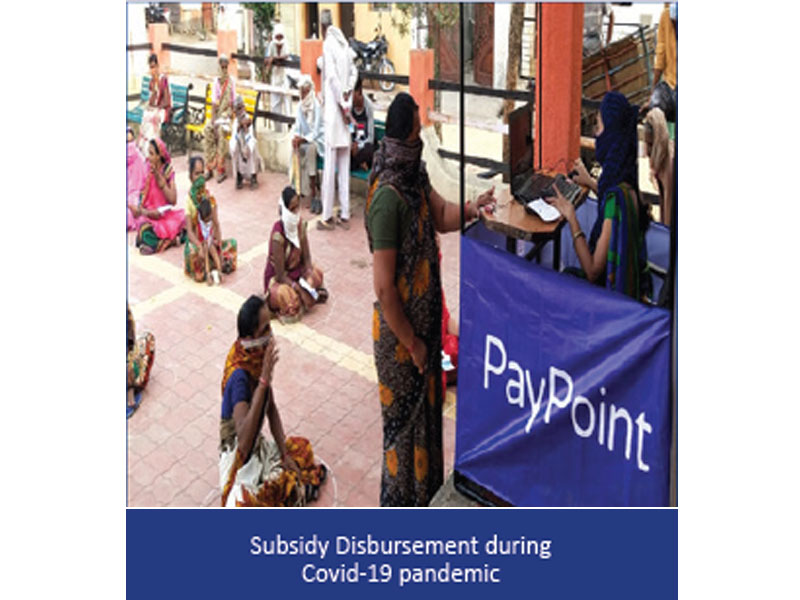

Even during the Covid-19 pandemic challenges last year, PayPoint strengthened its network and built deeper inroads to deliver financial services to the rural areas. During the extremely difficult times of the ongoing pandemic, Pay Point has catered to the payment and financial services requirements of over 50 million. customers, most of whom were poor and financially excluded.

Pay point is actively participating in Direct Benefit Transfer Scheme of the Govt. of India for Financial Inclusion and Poverty Alleviation, thereby proudly serving the country's macro vision with micro payments.

Tell us about the various products/services your company is currently offering.

We offer various services under one umbrella using the offline mode through the Paypoint India portal at the customer's doorstep. Here, the customer can make a cash payment to the retailer to avail the services.

We offer various services under one umbrella using the offline mode through the Paypoint India portal at the customer's doorstep. Here, the customer can make a cash payment to the retailer to avail the services.

Aadhaar ATM - Aadhar Enabled Payment System (AEPS) is a bank-led model that allows online financial transactions at micro ATM through the Business Correspondent of any bank using the Aadhaar authentication. Any Bank, Any Account, and Any Time Offer completes the banking experience for our customers.

E-Recharge- One stop solution for all telecom operators and DTH service providers

Pan Card- Online submission of application form and supporting documents, Aadhaar no.authentication

Travel- All domestic and international airlines are empanelled with us through aggregators. More than two lakh domestic hotels and five lakh international hotels are available to our customers for booking through our retail partners. All major bus operators, including state transport buses, MSRTC, UPRTC, and many more, are empanelled. Besides, PayPoint India is an authorized principal agent of IRCTC (Indian Railway Catering Tourism & Corporation).

Insurance- We facilitate affordable health insurance for families as also protection from loss of income and life.

What are the latest technologies you implement in your services?

Pay Point uses its own IT infrastructure to offer its digital services. There is a full-fledged IT wing that is technologically sound and trained for handling the latest versions and innovations.The tran saction platform is enabled with all front-ends like web, App, PoS, and QR. It uses biometric readers and micro ATMs.

During the Covid phase, the biometric system with mobile connectivity grew in popularity. Customer support staff pressed into service various online CRM tools to ensure seamless support during this period. Data analytics also played a significant role in the growth of the company's customer base.

At the core of PayPoint's operations is an innovative Conversational AI, a CRM tool with an integrated chatbot system. Additionally, we have also deployed mATM handheld devices in areas where people don't have access to basic banking services.

How do you ensure the quality of your services?

Thanks to the robust IT platform, transactions happen smoothly, seamlessly, and in real time across multiple channels desktop, laptop, tablets, mobile phones, PoS device, QR code, and the firm's own e-wallet. The success rate for transactions is 99.99 percent, and this contributes to customer satisfaction.

Explain About The Customer Support You Offer.

Even during Covid times, PayPoint's retailers and employees have been rendering service to the customers without interruptions. It has been estimated that since the time the lockdown was announced, the retail partners and employees have provided service to over 50 million customers.

PayPoint's staff members provide regular training/awareness programs for the retailers as well as its customers, a large percentage of whom belong to financially weaker sections. Language is not a barrier because employees and retail partners are usually local residents. In addition, there are call centers and chatbots to help customers.

Customer retention and satisfaction are of prime importance at PayPoint. Any customer complaint is taken very seriously and resolved immediately.

What are the various challenges/pain points your clients are currently facing while availing of your services? How are you helping them in overcoming those challenges?

Because of low digital literacy in rural India, where the company is trying to penetrate, customers need hand holding to realize the full potential of mobile payment solutions. Business correspond en Agentss hired from the same region play a crucial role in providing banking services to the unserved population.

Ever since the spread of the Covid-19 virus and the lockdown that followed, people have faced serious economic challenges, and there was a slowdown in consumer spending. But the trend has been reversed to a great extent in the subsequent period.

One of the challenges faced by all payment aggregators and customers is the cloning of websites by unscrupulous elements to carry out their fraudulent activities. While all possible measures are undertaken to prevent fraud, regulations need to be strengthened with regard to digital transactions.

Tell Us About Your Company's Recent Revenue Growth And The Future Roadmap?

In the current FY, the company has recorded an unprecedented CAGR of 53 percent in Gross Transactional Value, Revenue and gross profit grew by 50 percent, and 24 percent, respectively in 2021 over the previous year.

After a lull in customer spending resulting from lockdown in 2020, we have seen a 20 percent, growth in digital payments in the industry. The outlook is very positive for PayPoint, which hopes to consolidate its gains in the days and years to come.

Ketan Doshi, Managing Director

Ketan holds a Master's in financial services management from Mumbai University and a Diploma in Investment from Jamnalal Bajaj Institute of Management Studies.

A first generation entrepreneur, Ketan is on a mission to positively impact the livelihoods at the bottom of the economic pyramid. His inclination towards the fintech segment and the obsession to provide un matchable financial service to the last mile and the underserved seeded the incorporation of PayPoint India in 2008.

As the Managing Director at PayPoint India, he leads the team with his strategic intervention to convert the potential into active performance. His knowledge and experience in managing resources and operations complement his decision making prowess. While he recruits, mentors, and monitors the performance of the senior management, his ability to find the right talent has created a team that can take on any challenge and brings in inclusive growth.

Ketan has been a guest speaker at several fintech and payment events, including a few esteemed panels of top media houses in India. Under his leadership, PayPoint has achieved tremendous growth and conferred with prestigious awards & recognitions over the years.

Even during the Covid-19 pandemic challenges last year, PayPoint strengthened its network and built deeper inroads to deliver financial services to the rural areas. During the extremely difficult times of the ongoing pandemic, Pay Point has catered to the payment and financial services requirements of over 50 million. customers, most of whom were poor and financially excluded.

Paypoint's strength is its deep-rooted penetration of rural and semi-urban India with a network of 64,000 retailers and a bouquet of services

Pay point is actively participating in Direct Benefit Transfer Scheme of the Govt. of India for Financial Inclusion and Poverty Alleviation, thereby proudly serving the country's macro vision with micro payments.

Tell us about the various products/services your company is currently offering.

We offer various services under one umbrella using the offline mode through the Paypoint India portal at the customer's doorstep. Here, the customer can make a cash payment to the retailer to avail the services.

We offer various services under one umbrella using the offline mode through the Paypoint India portal at the customer's doorstep. Here, the customer can make a cash payment to the retailer to avail the services.

Aadhaar ATM - Aadhar Enabled Payment System (AEPS) is a bank-led model that allows online financial transactions at micro ATM through the Business Correspondent of any bank using the Aadhaar authentication. Any Bank, Any Account, and Any Time Offer completes the banking experience for our customers.

E-Recharge- One stop solution for all telecom operators and DTH service providers

Pan Card- Online submission of application form and supporting documents, Aadhaar no.authentication

Travel- All domestic and international airlines are empanelled with us through aggregators. More than two lakh domestic hotels and five lakh international hotels are available to our customers for booking through our retail partners. All major bus operators, including state transport buses, MSRTC, UPRTC, and many more, are empanelled. Besides, PayPoint India is an authorized principal agent of IRCTC (Indian Railway Catering Tourism & Corporation).

Insurance- We facilitate affordable health insurance for families as also protection from loss of income and life.

What are the latest technologies you implement in your services?

Pay Point uses its own IT infrastructure to offer its digital services. There is a full-fledged IT wing that is technologically sound and trained for handling the latest versions and innovations.The tran saction platform is enabled with all front-ends like web, App, PoS, and QR. It uses biometric readers and micro ATMs.

During the Covid phase, the biometric system with mobile connectivity grew in popularity. Customer support staff pressed into service various online CRM tools to ensure seamless support during this period. Data analytics also played a significant role in the growth of the company's customer base.

At the core of PayPoint's operations is an innovative Conversational AI, a CRM tool with an integrated chatbot system. Additionally, we have also deployed mATM handheld devices in areas where people don't have access to basic banking services.

How do you ensure the quality of your services?

Thanks to the robust IT platform, transactions happen smoothly, seamlessly, and in real time across multiple channels desktop, laptop, tablets, mobile phones, PoS device, QR code, and the firm's own e-wallet. The success rate for transactions is 99.99 percent, and this contributes to customer satisfaction.

Explain About The Customer Support You Offer.

Even during Covid times, PayPoint's retailers and employees have been rendering service to the customers without interruptions. It has been estimated that since the time the lockdown was announced, the retail partners and employees have provided service to over 50 million customers.

PayPoint's staff members provide regular training/awareness programs for the retailers as well as its customers, a large percentage of whom belong to financially weaker sections. Language is not a barrier because employees and retail partners are usually local residents. In addition, there are call centers and chatbots to help customers.

Customer retention and satisfaction are of prime importance at PayPoint. Any customer complaint is taken very seriously and resolved immediately.

What are the various challenges/pain points your clients are currently facing while availing of your services? How are you helping them in overcoming those challenges?

Because of low digital literacy in rural India, where the company is trying to penetrate, customers need hand holding to realize the full potential of mobile payment solutions. Business correspond en Agentss hired from the same region play a crucial role in providing banking services to the unserved population.

Ever since the spread of the Covid-19 virus and the lockdown that followed, people have faced serious economic challenges, and there was a slowdown in consumer spending. But the trend has been reversed to a great extent in the subsequent period.

One of the challenges faced by all payment aggregators and customers is the cloning of websites by unscrupulous elements to carry out their fraudulent activities. While all possible measures are undertaken to prevent fraud, regulations need to be strengthened with regard to digital transactions.

Tell Us About Your Company's Recent Revenue Growth And The Future Roadmap?

In the current FY, the company has recorded an unprecedented CAGR of 53 percent in Gross Transactional Value, Revenue and gross profit grew by 50 percent, and 24 percent, respectively in 2021 over the previous year.

After a lull in customer spending resulting from lockdown in 2020, we have seen a 20 percent, growth in digital payments in the industry. The outlook is very positive for PayPoint, which hopes to consolidate its gains in the days and years to come.

Ketan Doshi, Managing Director

Ketan holds a Master's in financial services management from Mumbai University and a Diploma in Investment from Jamnalal Bajaj Institute of Management Studies.

A first generation entrepreneur, Ketan is on a mission to positively impact the livelihoods at the bottom of the economic pyramid. His inclination towards the fintech segment and the obsession to provide un matchable financial service to the last mile and the underserved seeded the incorporation of PayPoint India in 2008.

As the Managing Director at PayPoint India, he leads the team with his strategic intervention to convert the potential into active performance. His knowledge and experience in managing resources and operations complement his decision making prowess. While he recruits, mentors, and monitors the performance of the senior management, his ability to find the right talent has created a team that can take on any challenge and brings in inclusive growth.

Ketan has been a guest speaker at several fintech and payment events, including a few esteemed panels of top media houses in India. Under his leadership, PayPoint has achieved tremendous growth and conferred with prestigious awards & recognitions over the years.